The newly proposed Economic Crime and Corporate Transparency Bill has garnered attention since its announcement. With proponents stating it will improve transparency over UK companies and other legal entities, with a focus on fixing the UK’s growing reputation as a haven for dirty money.

The UK and its financial service sector is currently focused on the cost of living crisis and stabilising the market, but with The National Crime Agency currently estimating that money laundering costs the UK more than £100 billion annually, preventing the flow of illicit funds out of the UK economy could be a key component of this fiscal strategy.

But detractors of the bill say it could harm the UK government’s efforts to establish the UK as a centre for crypto exchange, with the tighter controls of digital currencies a key focus of the proposed legislation.

Components of the Economic Crime and Corporate Transparency Bill

The new bill is geared to strengthen the UK’s reputation as a place where legitimate businesses can thrive while driving dirty money out of the UK.

The key components of the bill cover four areas of UK business and financial services.

Companies House reform

The proposed reforms to Companies House itself evidence the growing concern over illegitimate entities as a result of weak verification controls. Its broad reforms clamp down on misuse of corporate entities and aim to cut off criminals’ access to UK financial services by improving registrations.

Improved verification of company directors: The most significant change proposed is the mandatory verification of identity for those joining and filing with Companies House, under the proposal directors cannot be appointed until their identity has been verified. The bill is not specific on how the verification will be conducted, but it would likely require Companies House to carry out checks similar to Electronic Identity Verification (eIDV) processing. It is hoped that these stronger KYC and onboarding-type controls will provide richer data to support law enforcement investigation, in case of financial crime suspicion.

Improved financial information on the register: ensuring that the register reflects the latest enhancements in digital technology, with a focus on reliable, complete, and accurate data.

Enhanced powers and collaboration: Companies house will take a more effective investigation and enforcement role with an extension of its powers, and be able to better collaborate with other key bodies, regulators, and law enforcement. Better cross-checking of data and proactive sharing of information where there is evidence of anomalous filings or suspicious behaviour.

Data protection: Personal information provided to Companies House will be better protected, with a view to reducing the risk of fraud against those.

Limited partnership reform

Registration requirements will again be more stringent to improve transparency and tackle the misuse of limited partnerships, including Scottish limited partnerships.

Cryptoassets

New digital currencies such a crypto currency are a large focus of the proposed reforms. The bill would provide for reinforced law enforcement capabilities around decentralised finance (DeFi).

Seize and freeze: With additional powers law enforcement could move faster to seize and recover cryptoassets when they are the proceeds of a crime, or associated with illicit activity such as money laundering, fraud, and ransomware attacks.

The bill proposes to: “Principally amend both criminal confiscation powers in Parts 2, 3 and 4 of the Proceeds of Crime Act 2002 (POCA) and civil recovery powers in Part 5 of POCA to enable enforcement agencies to more effectively tackle criminal use of cryptoassets.”

Strengthening anti-money laundering powers

Improving the UK’s record on Anti-Money Laundering (AML) is a national priority, as such the bill proposes to strengthen the power of the industry to enforce AML through better information sharing on suspected money laundering, as well as fraud and other economic crimes. This shows the growing understanding of the link between the three.

- Share: Information sharing for the purposes of preventing, investigating, or detecting economic crime will be made easier, by disapplying civil liability for breaches of confidentiality for firms who share information to combat economic crime.

- Gather: Removing the requirement for a pre-existing Suspicious Activity Report (SAR) to have been submitted before an Information Order (IO) can be made would enable proactive intelligence gathering by law enforcement. And enrich the National Crime Agency’s Financial Intelligence Unit’s (FIU) information direct from businesses relating to money laundering and terrorist financing.

- Prioritise: Expanding the types of case in which businesses can deal with clients’ property without having to first submit a Defence Against Money Laundering (DAML) SAR seeks to reduce the reporting burden on businesses and enabling greater prioritisation of law enforcement resource on high value activity.

The need for the Economic Crime and Corporate Transparency Bill

The digital economy has transformed the way businesses operate and has created new opportunities for growth, but with every genuine opportunity there is also a criminal looking to exploit it.

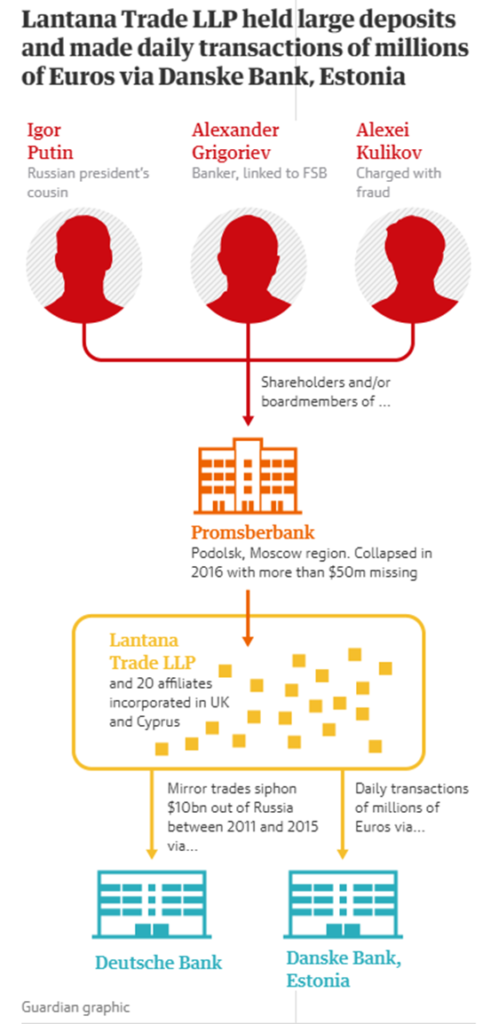

The current frameworks and processes at Companies House have enabled criminal individuals and networks to take advantage through shell schemes and corrupt financiers to assist them to commit fraud and broader financial crime. There are high profile cases of wide-scale abuse, such as the mirror trading schemes operating out of Russia that laundered £2.2 billion through opaque British companies. The need for transparency in both the entities operating in the UK financial system as well as the transactions themselves is clear. The proposed bill aims to make it increasingly difficult for these schemes by increasing the legitimacy of the information available on Companies House and increasing their power to scrutinise that information.

In the UK, many businesses and individuals in the UK must register with a supervisory authority to follow anti-money laundering regulations, including (but not limited to) financial and credit businesses, and high value dealers (handling cash payments of €10,000 or more in exchange for goods). These businesses and individuals must register with the supervisor that regulates their specific industry, and may need to register with HMRC if they do not have a listed supervising body.

Although this supervisory capacity exists, the reality is that many company service providers are believed to have inadequate policies and procedures in place to prevent abuse; they do not meet requirements to check directors, shareholders, and beneficial owners; and based on inaction to date they are unlikely to come under scrutiny from HMRC or be subject to enforcement action.

In an attempt to limit such abuse and to enable a reliable, transparent system for both domestic and international businesses to incorporate entities in the UK, Companies House must adapt to keep pace with the rapid changes within the digital economy.

The impact on AML teams

Through the recent and planned reforms, anyone who registers a company in the UK will need to verify their identity, tackling the use of companies as a front for criminal organisations or foreign kleptocrats. There is an increased focus on AML in relation to combatting crime at large in the UK, with both the domestic impacts and international reputational damage of failing to do so, a major concern.

There will be an impact on AML transaction monitoring, with a need for stronger scrutiny on entities in the payment chain, even if they are registered at Companies House. Additionally, AML teams will feel a major impact in that they will be expected to provide more timely and detailed data to law enforcement. Highly explainable and easily interrogable systems will be crucial in meeting the heightened expectations of the regulator should this bill come to pass.

The upgrade in investigation and enforcement powers of Companies House will require more diligent cross-checking of data with public and private partners to support the reporting of suspicious activity to the regulators and law enforcement agencies. This is added to the discrepancy reporting requirements from

We do not as yet know the full extent of this possible requirement, but we expect some financial institutions to face a challenge around the new data requirements. Many financial institutions have begun to run shadow Skilled Persons Reports (Section 166 reports) to uncover these new discrepancies.

How to prepare for change in Economic Crime and Corporate Transparency regulation

Many legacy risk strategies used by established FIs are ill-suited to the complexities of modern money laundering and fraud. Critical data for investigations is siloed, as AML is often considered to be a matter for compliance teams, while fraud is frequently viewed as a matter of operational and or security teams.

With the proposed bill indicating that more granular investigations will need to be carried out in combination with enhanced KYC, and regulatory headwinds suggesting a convergence of thinking around financial crime and fraud, it would be prudent for FIs to begin to consider a modern, holistic approach to their systems.

Learn more about the benefits of a converged approach to financial crime and fraud in response to regulation in this article from Todd Raque, financial crime SME.

The Modern Risk Hub – Why FIs are converging fraud and AML systems

Share