Scam Detect

Your Bank’s Loyal Guard Dog

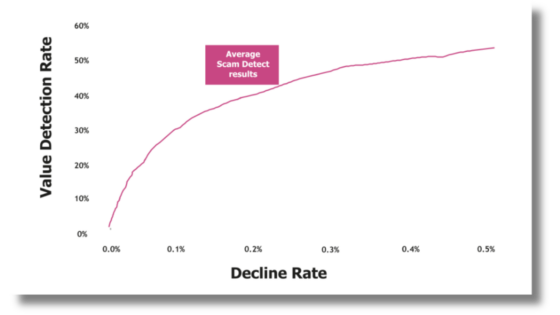

Scam Detect is the ultimate way to protect your bank against APP fraud. It sniffs out scammers in real time using cutting-edge behavioral analytics and best-in-class Artificial Intelligence models.