Everyone has a scam story. And if you don’t have one from personal experience, you’ll sure enough know someone who does. Is 2023 set to be the year of the scam? Are we facing our next ‘demic…the Scamdemic!?

Want to know how the ‘good guys’ are taking back control and outsmarting the criminals? Read on to get our Founder Dave Excell’s predictions and insights for the year ahead.

Economic recession + faster payments = scams

Not a day goes by without a scam story hitting the media. And, with the dreary economic backdrop predicted, we can expect to see many more. Why? Because during an economic downturn, more criminals turn to fraud as an easy way to make money…and more people fall victim as they become acutely focussed on their own financial situation. And now we have the extra dimension of faster payments opening up in new markets around the world.

These are the conditions that will lead to an increased number of individuals being a victim of ‘Authorised Push Payment’ fraud, also known as APP fraud or more commonly Scams. Or, driven to committing first party fraud; this is when the genuine customer claims the transaction was not undertaken by them when it was.

In the UK alone, consumers – people like you and me – lost a total of £250 million to scams in the first half of 2022 and around the same amount to unauthorized card fraud.

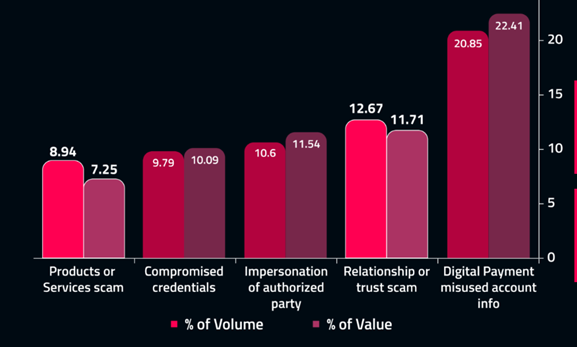

Scams also represent two out of five of the top fraud categories in the US for volume and losses, according to Featurespace’s State of Fraud and Financial Crime in the US report, structured around the FraudClassifier model from the Federal Reserve.

Scams are on the rise in the U.S.

As criminals continue to find opportunities in times of uncertainty to brazenly exploit vulnerabilities across society – spurred on by new technologies like faster payments – we predict these scam numbers to rise throughout 2023. So, watch out for more social media scams, investment scams, merchandise scams, deepfakes and insider recruitment, as criminals become more sophisticated than ever.

“Get control of scams…and help me find savings”

In 2023 many financial institutions are going to be hit with the double whammy of trying to get control of scams, while at the same time bring down the cost of their fraud operations.

To meet this challenge and run an efficient financial institution, fraud experts must consider how they are calculating the total cost of fraud. This means making sure they adopt a three-way method that includes technology, processes, and people to get better results.

Throughout 2023, we predict a significant increase in the employment of Machine Learning, and increasingly deep learning, to automate and improve risk decisions that stops fraud in its tracks. In fact, data from our own report tells us that over 70% of FIs plan to improve existing solutions to combat fraud in the next six to 12 months, and those already adopting Machine Learning and Artificial Intelligence are experiencing the lowest levels of financial crime.

Machine Learning is table stakes. Deep Learning can truly disrupt the entire fraud chain.

We’re getting fatigued hearing how the past two years “has fundamentally changed consumer activity…driven by global events such as the pandemic…”.

Thing is it’s all true. And what it means for fraud prevention is that as the economic landscape becomes increasingly turbulent, machine learning models will again have to rely less on historic data to make decisions.

This is no problem for those adopting Deep Learning. As Deep Learning continues to advance financial institutions’ fraud prevention tools and disrupt the entire fraud chain, it is now possible to do more with less. Deep Learning techniques, like Automated Deep Behavioral Networks, allow financial institutions to be more efficient in their data acquisition costs and system integrations to optimize their fraud strategies.

According to UK Finance, FIs investing in advanced security systems have already prevented around £600 million of unauthorized fraud in the first half of 2022. This is the equivalent of 60p in every £1 of attempted fraud being stopped without a loss occurring. Looking ahead, we’re excited to see how increased adoption of Deep Learning will transform financial institutions’ fraud and financial crime prevention strategies.

Regulatory focus will continue to be on consumer protection…

The Payment Systems Regulator (PSR) has scams front of mind. The recent completion of the CP22/4: Authorised push payment (APP) scams: Requiring reimbursement consultation sought feedback from the UK industry on the potential impact of scam reimbursement, including banks and fintech.

The potential impact on FIs could include:

- Mandatory reimbursement in all but exceptional cases

- 50:50 liability between the receiving FI and the sending FI

- More incentives for FIs to combat scams head-on with technology, in particular Machine Learning, or even better, Deep Learning

Financial Institutions must get ahead of the criminals, and ahead of the regulation, to reduce the impact when the changes officially come into play. Where there isn’t already fraud detection applied to inbound payments, FIs should introduce this sooner rather than later, as there will be some initial quick wins when putting inbound payments through a fraud detection engine. Longer term, this will build into standalone models and in the future, a holistic approach within one solution.

… it is predicted to change in the United States…

P2P transaction fraud is a hot topic at present for The Consumer Financial Protection Bureau (CFPB), following the interest from United States Senators to tackle the issue through a proposed amendment to the Electronic Fund Transfer Acts (EFTA) Reg E. The current legislation only includes reimbursement of unauthorized transactions.

So, what does this possible shift mean for US FIs?

- Extension to include liability on banks, credit unions and smaller FIs to reimburse scam victims

- Increased regulatory burden on FIs, especially on small to mid-sized FIs

- Focus on developing a cost-effective fraud and financial crime prevention strategy, while remaining compliant

…and APAC too

In APAC, consumer protection against scams is no less of a priority. The Australian Securities and Investments Commission (ASIC) has set combating and disrupting investment scams as one of its 2023 priorities. Over the next year, FIs in Australia will be required to do more to prevent scams as part of their general duties to consumers. The Australian Competition and Consumer Commission is also lobbying for Confirmation of Payee to prevent funds reaching scammers and make ‘Australia the world’s hardest target to scam’.

Scams focus is equally important in Singapore too. Between the period of January to June this year (2022), the Singapore police froze more than 7,800 accounts and recovered over S$80 million in scams proceeds. The Monetary Authority of Singapore (MAS) is working on a framework around the equitable sharing of losses from scams. The framework, once finalized, is due to share liability fairly across the ecosystem and incentivize FIs to be vigilant in combatting scams to protect consumers.

Getting control and outsmarting the criminal

Collaboration and partnership in the industry will be key in the fight against scams, as well as fraud and financial crimes more broadly.

Enabling and proactively engaging in information sharing across the industry and with law enforcement will be vital. FIs will need to create the right partnerships to support and encourage information sharing. Organizations, such as the ACFE, play a crucial role in this education.

Leveraging a holistic view of customer risk enabled by technology and developing processes to capture feedback on program inputs and data critical to identifying and understanding current and emerging risks.

Considering the focus around a collaborative approach, the UK and US governments have recently joined forces to encourage business to put themselves forward to transform financial crime prevention. The PETs (privacy enhancing technologies) challenge prize‘s aim is to develop privacy-preserving solutions that allow AI models to be trained on sensitive private data – important for revealing criminal activity – without organizations having to reveal, share, or combine their raw data. Collaboration in its safest form, whilst maintaining huge transformative potential.

Collaboration, combined with the adoption of advanced innovation such as Deep Learning to protect against scams and financial crimes more broadly, will be the key to outsmarting the criminals whilst remaining compliant. Applying 360° behavioral profiling of your customers and focusing on understanding genuine behavior (both monetary and non-monetary) will continue to play a pivotal role in combatting the threat of scams.

Find out more about how Featurespace could arm you with world-leading scams control here >>

Share

by

by