Playing cat and mouse in financial crime prevention

The global financial system reminds me much of the kids cartoon Tom and Jerry, Tom (the financial system) is continually trying to catch and stop Jerry, (the money launderer(s)*). Jerry is increasingly smart and swift allowing him to evade capture from Tom.

In this example the money launderer is any criminal attempting to place illicitly obtained or retained funds into the financial system, in attempt to mask the money’s true origin and enable the money launderer’s or another’s ‘legitimate’ use of the said illicit funds.

Having said this, Tom trusts the innovators, regulators and law enforcement officials who continually develop newer and better strategies for investigating these crimes.

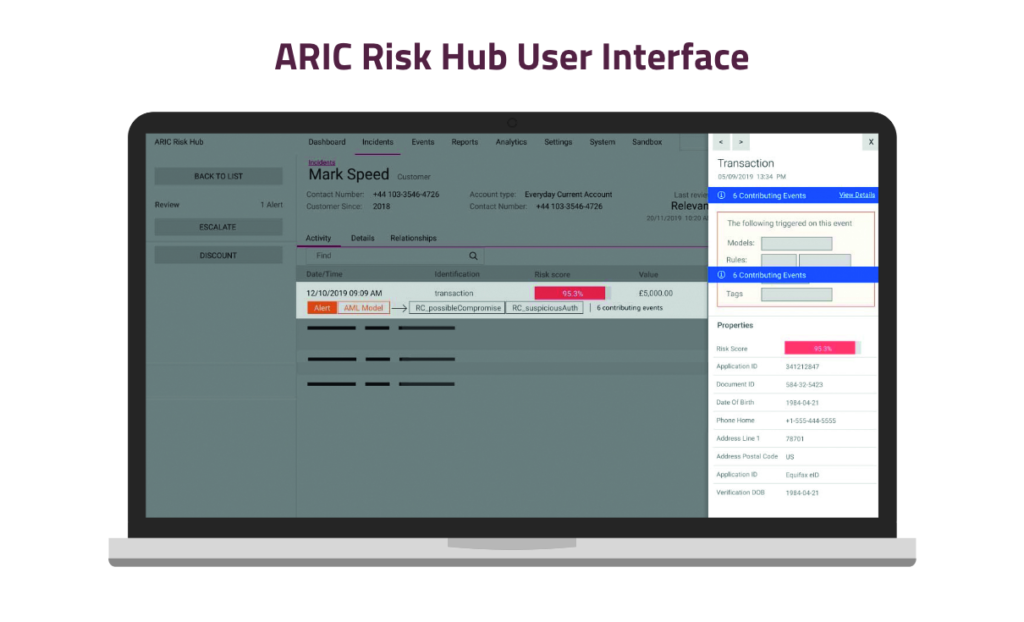

Until recently, financial institutions primarily relied on reacting to rules-based anti-money laundering (AML) systems that flag suspicious activity. Whether transactions were over a certain threshold, or money flow into a specific high-risk country or similar, simplified rule. Alongside, the rapid evolution of financial technology and seamless connections between banking and payments networks, an opportunity has emerged for Jerry to work around these rules-based AML systems. This is where Artificial Intelligence (AI) type systems such as Featurespace’s ARIC™ Risk Hub enter the picture, helping Tom to limit and even catch Jerry.

In this article we describe how AI is being used to fortify financial institutions’ AML systems and enable a robust, risk-based approach to AML with fintech solutions such as ARIC.

What is AML?

AML refers to all the actions financial institutions (or other applicable firms) undertake to achieve legal and regulatory compliance, endeavouring to prevent criminals from adding or moving (placing) illegal funds into the financial systems, and detect funds of illicit origin already integrated into these systems.

Money laundering continues at massive scale, it is estimated that trillions of $USD are washed into the global economy through financial crime each year. So scalable solutions such as AI technologies are pivotal in scaling up AML programs.

The importance of AI in AML

AI technology can help financial institutions detect money laundering activities in transaction monitoring — even when criminals try to hide that activity by stealing peoples’ identities or hiring money mules to facilitate transactions.

AI is a key component in latest-generation AML systems because it automates many of the key processes of AML systems and looks at larger data sets, at a deeper scale than humans possibly could.

Nestled within the realm of AI are technologies like machine learning (ML) and deep learning (DL), which can help financial institutions understand the genuine behaviors of their customers. Adaptive Behavioural Analytics and Automated Deep Behavioural Networks, proprietary inventions by Featurespace in adaptive machine learning and deep learning, allow those institutions to build more accurate profiles of what constitutes genuine customer behavior, and what behavior should be flagged as suspicious.

These types of technologies enable the development of a more efficient, more scalable AML program.

Key Industry Concerns with AI in AML

There are three common concerns currently amongst compliance professionals:

- Are AI systems fair?

- Is the dataset used to train the system truly representative?

- How does the compliance professional check effectiveness and critique the system(s)?

Fairness with respect to AI systems is inherently difficult to debunk, data (past transactions) which the system is told by the designer are either usual or unusual behavior, AI then uses this to prejudice new transactions. In theory the more transactions it processes the more fair and more accurate the system will become.

There are six risks that financial institutions may face when using machine learning for AML transaction monitoring:

- The model design may be flawed

- The choice of sampling may either be poor or limited

- Algorithms may have mistakes that mean they fail to carry out the purpose of the model

- Shortcuts or simplifications used to manage complicated problems could compromise the reliability of outputs

- The quality of data input may be insufficient, leading to sub-optimal, or even useless results

- The user may not understand the limitations of the model and expect the model to do too much

The completeness of a data set is an AI industry-wide problem, this is currently being explored by the Financial Conduct Authority in the UK using synthetic data. We support the idea of greater industry and law enforcement data sharing, and more accessible data would enable this. In projects with our customers, we integrate a more representative data set for the AI system to learn from where possible.

Featurespace’s Model Governance Framework was developed by working hand in hand with our customers, investigators and regulators. The underpinnings of this framework capture Featurespace’s Machine Learning Equality Policy and our commitment to creating solutions that enable impartial access to financial services products. Regardless of whether a model was designed by Featurespace or developed by a customer, the decisioning process of models, remains effective and fair after deployment.

Learn more about the Featurespace approach to Model Governance for Anti Money Laundering

On way to ensure model fairness it to prioritize model explainability. ARIC makes the output of machine learning models understandable to investigators, providing them with the context they need to analyse alerts further. If the investigators understand why each alert is raised, they are in a better position to work the alerts.

How Featurespace can support AML functions with AI

Featurespace’s ARIC™ Risk Hub is built with ML and DL technologies.

Our Adaptive Behavioural Analytics technology specifically gives financial institutions a more complete view of risks across their customer portfolio, making AML more efficient by reducing false positives and prioritizing alerts based on our customers risk appetite, and finds connections in the data that reveal unforeseen threats that may have taken an analyst hours, days or even weeks.

Our AML technology is useful across a variety of applications, including but not limited to:

- In retail banking, where the efficiency ARIC™ creates can bring down the cost of compliance.

- In payment services, Adaptive Behavioural Analytics provides a richer context for identifying the behaviors of money launderers.

- In insurance, Adaptive Behavioural Analytics can reveal emerging methods of money laundering.

- In correspondent banking, machine learning can help uncover transnational networks of financial crime.

A new approach to AML

In late 2020, PwC Canada National Financial Crime Practice Leader Ivan Zasarsky spoke with Araliya Sammé, Head of Financial Crime at Featurespace, and Annegret Funke, Financial Crime Senior Solutions Consultant at Featurespace, about the new paradigm AML teams are embracing.

Rather than a rules-based approach, a more robust risk-based approach has emerged, thanks in large part to the technologies described above.

To learn more, have a look at their webinar below:

Anti-Money Laundering – Enterprise Fraud and Financial Crime Series

How is Featurespace helping businesses fortify their AML systems?

HSBC is one example of a financial institution that recognised AI’s capabilities in detecting and preventing money laundering.

A few years ago, HSBC’s insurance business partnered with Featurespace in an effort to increase efficiency in its transaction monitoring capabilities.

Our team delivered a cloud-based implementation of ARIC™ Risk Hub, which has since helped the bank reduce false positive alerts and improve the quality of generated alerts by identifying new risk scenarios.

How have we helped regulators get to grips with these innovations?

At the end of 2021, the U.S. Financial Crimes Enforcement Network (FinCEN) sent out a request for information from across the financial sector for ideas as to how it can modernise its AML controls and better combat organised crime with tools like artificial intelligence.

Our team responded with four primary recommendations:

- Structure data so that financial institutions can more easily leverage new AML solutions.

- Facilitate better data sharing.

- Define the level of model explainability financial institutions should pursue.

- Update frameworks with specific, not broad language on AML innovations.

Our view is that technology has a major role to play in fighting money laundering and broader financial crime risks and making the world in general a safer place for consumers and financial institutions. This is the mission we work toward every day.

It’s within that orientation that we see AI continuing to fortify the financial system.

Learn more

To learn more about how your business can fortify, develop and modernise its compliance programme to proactively combat money laundering, get in touch or request a demo today.

Share