3.16 Release

Fighting Financial Crime more efficiently with ARIC 3.16

While Valentine’s Day and the days leading up to it is a peak opportunity for organized criminals to prey on the purse strings of those looking for love, financial crime is really an all-time concern. Criminals know that during peak periods – the festive season and other holidays – merchants can be overwhelmed with volumes of orders they don’t see year-round. To ensure that legitimate Valentine’s Day customer orders are not exposed to unnecessary friction, fraud and money laundering prevention systems need to monitor all transactions, in real-time, across multiple channels to stop criminal harm to businesses and their customers.

Better together

Featurespace’s ARIC™ Risk Hub enables banks and payment processors to combat criminals with a unique combination of Adaptive Behavioral Analytics, anomaly detection and advanced machine learning. By monitoring individual profiles in real-time, ARIC Risk Hub offers 7 solutions across fraud and anti-money laundering, to catch more crime while also recognizing ‘good’ behavior and allowing genuine customers to transact.

Coinciding with Valentine’s Day this year, the release of ARIC™ 3.16 is set to pull at the heartstrings of any fraud fighter and anti-money laundering expert. As part of our commitment to our customers, we are constantly enhancing our award-winning product and technology platform with new features designed to reduce customer friction, enhance incident monitoring, speed up management workflows, enhance resiliency and ensure that financial crime prevention teams can outsmart criminals more effectively than ever.

ARIC Risk Hub V3.16: enhanced features for optimum usability and workflows

Adaptive Rules Engine

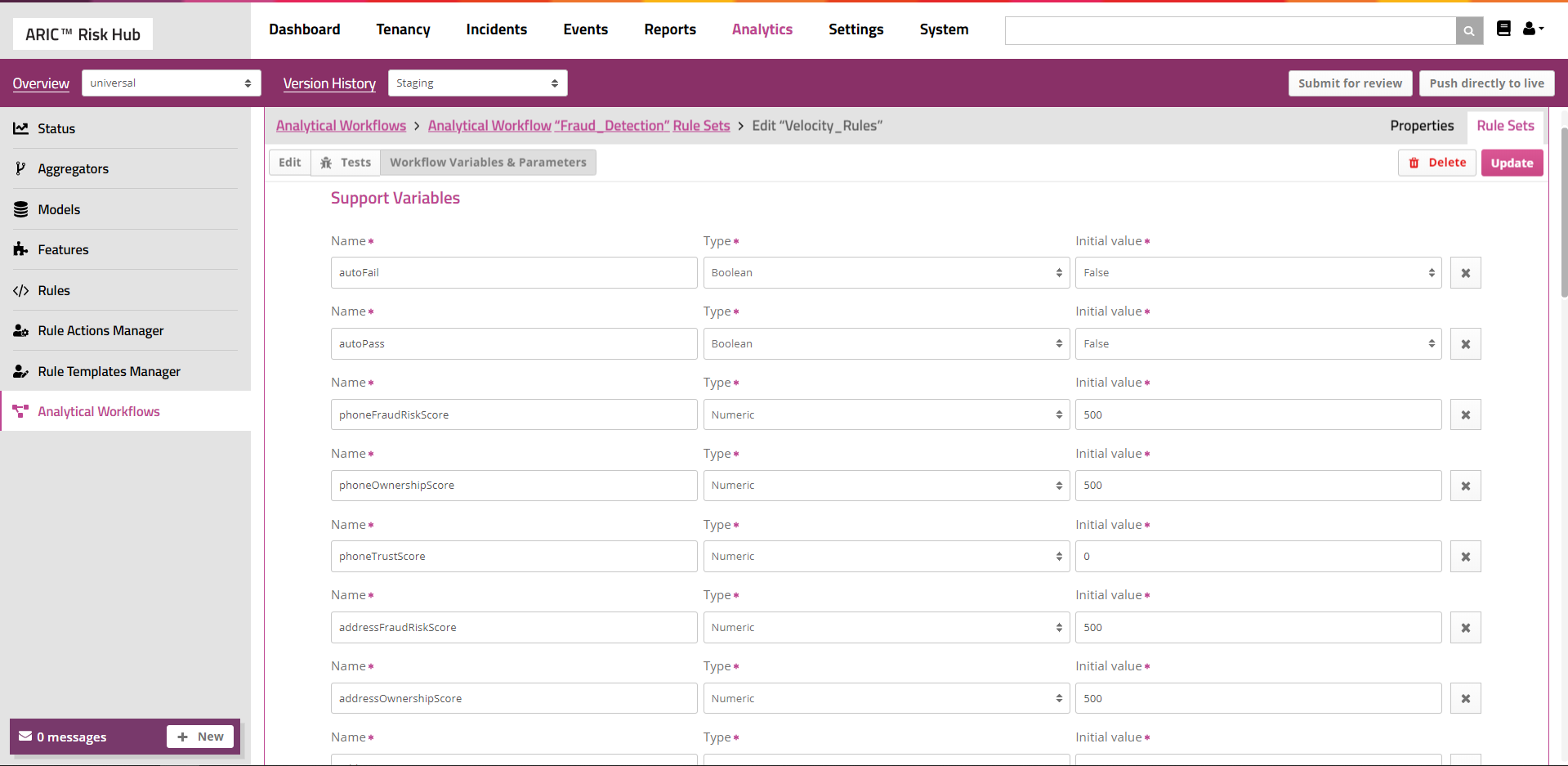

NEW Analytical Workflow Manager

- Get sophisticated flow control for the ARIC real-time Adaptive Rules Engine

- User-friendly interface to build business logic and advanced rules orchestration – including third-party callouts

- Visually structure the business logic which apply to events through Rule Sets and Scorecards

Analytical Workflow Manager is a new way to define and execute Featurespace’s adaptive rule-writing language (ARIC Model Definition Language – AMDL) within the Adaptive Rules Engine. Analytical Workflow Manager can run alongside our rule-writing language and is ideal for use cases such as application fraud monitoring or the recreation of business logic, such as dispute handling, which requires the risk of a single event to be assessed in a workflow manner.

Analytical Workflow Manager enables ARIC users to implement a series of conditional Rule Sets to make it easy to control when analytics call out to external services such as email, phone or device risk data. This enables risk teams to order their callouts, choosing whether or not to call out to external services at all based on the risk level of the event or the risk level of a component of the event. E.g. only call out to Emailage when the email address is high risk.

In a Multi-tenancy environment, Analytical Workflow Manager enables Landlords of a White Label ARIC Platform to create and manage workflows and apply them to all tenants of their ARIC system. Landlords can control which default values set in the workflow may overridden by tenants. This enables individual tenants to customize workflows to ensure they meet their business risk appetite.

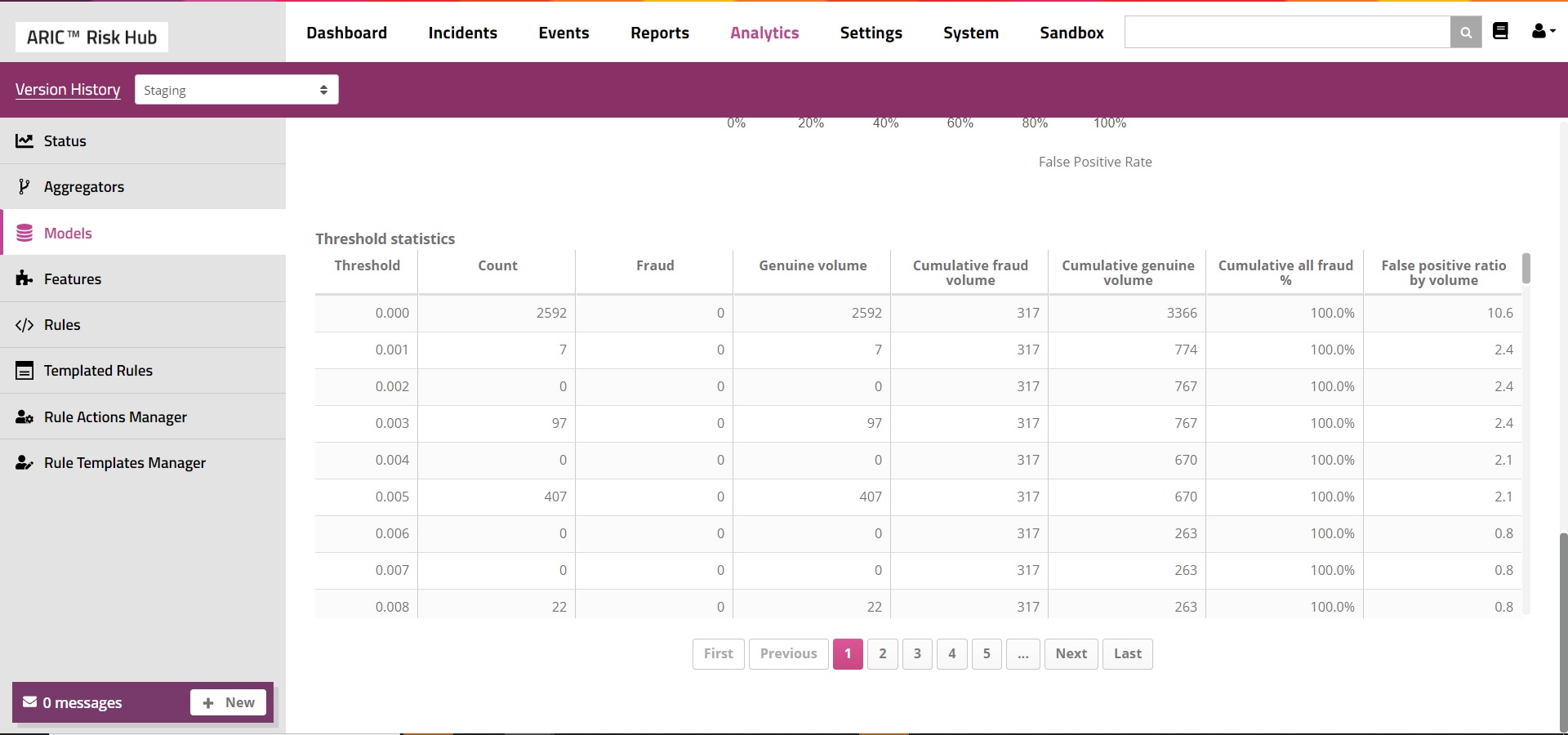

ARIC Open Modeling Environment

Full lifecycle model management

- Mature analytics offline and promote to live without downtime, supplementing existing capability for data science teams to build, train and deploy their own models alongside ARIC’s adaptive machine learning models.

Reporting

Enhanced reporting options

- Performance reporting for third-party models: ARIC 3.16 provides detailed performance reporting for data science teams choosing to deploy their own risk detection models in a third-party format (PMML, H2O or TensorFlow) in ARIC’s Open Modeling environment. This enables customers to evaluate model performance to allow adjustments that develop the most accurate model possible.

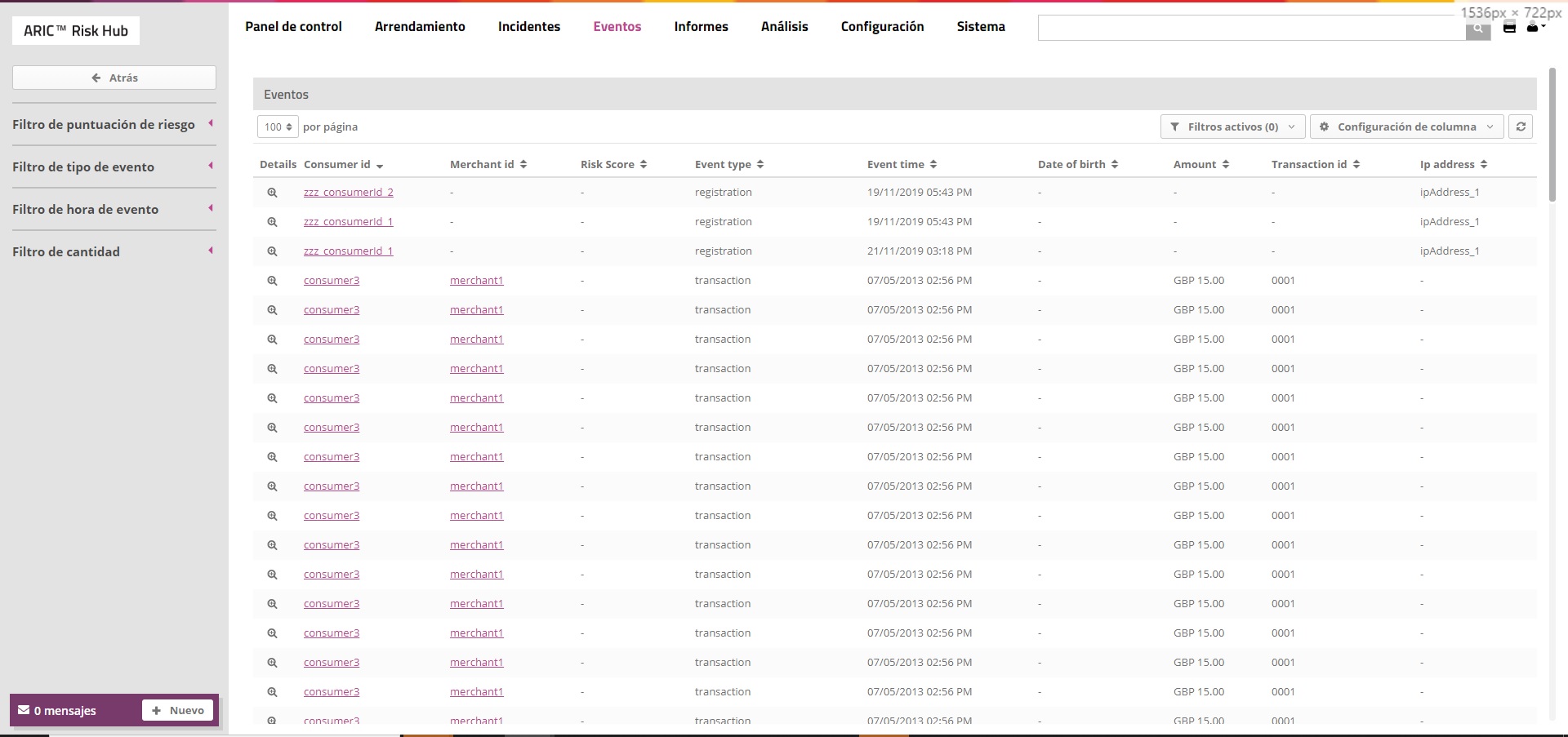

User Interface (UI)

User Interface customization improvements to fight crime faster

- New time difference display option enabling financial crime prevention teams to easily identify anomalous patterns in behaviour, with filters to display the age and time difference of when an event/s occurred.

- Enhanced incident filters allowing specific incidents or groups of incidents to be assigned to different teams.

- Customize currency views if operating in more than one currency, to easily display original or other currencies which are present in specific event.

- Translatable User Interface – can be translated into any language

Processing Control

- Enhanced access to troubleshooting tools directly through the ARIC User Interface, to enable our Support Team to help you resolve issues faster and more efficiently

Share