It seems pretty straightforward… there are people who don’t commit fraud – your good customers – and people who commit fraud – the ones you set your systems up to detect. However, if you work in fraud prevention you know that line often becomes quite blurred.

First party fraud is very common, presenting major problems for issuers, merchants and financial institutions across a variety of fraud use cases. The current pandemic has caused global economic hardship, simply adding fuel to this fire. The old adage, “desperate times call for desperate measures” is becoming more relevant these days and will drive higher rates of first party fraud.

Take application fraud for instance. The graphic below does an excellent job of showing the slippery slope genuine customers navigate as they attempt to clean up their credit (thank you Frank McKenna!). They begin with legitimate intentions and before long, their actions become more sinister.

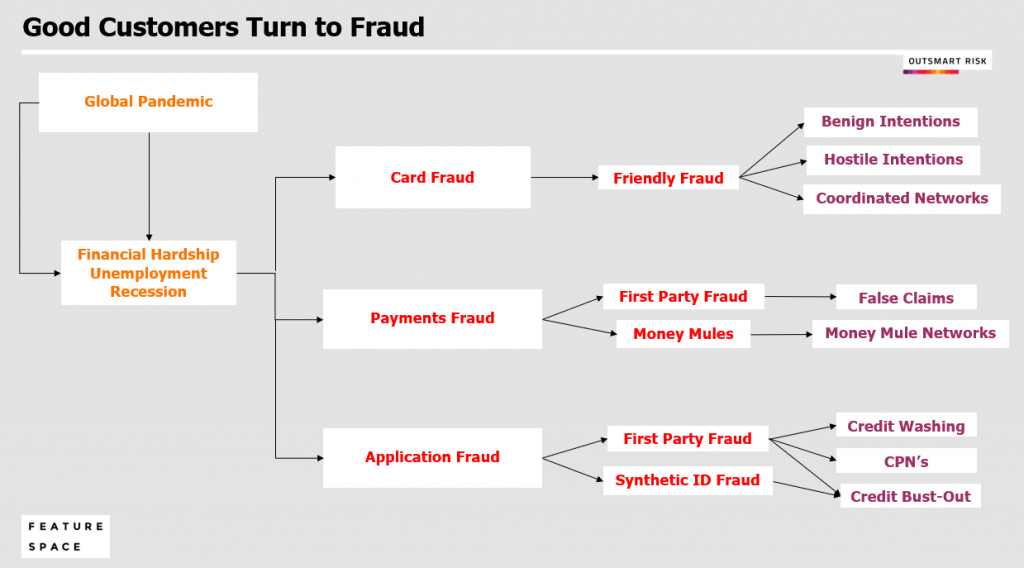

Economic hardship will drive some folks to access to money by any means necessary. This includes, card fraud, payments fraud and application fraud. Below illustrates how this journey progresses and the amplified fraud impact.

Perhaps the most maddening part of it all: this type of fraud is super easy to commit yet extremely challenging to detect (as compared to third party fraud). Clearly this is not the balance you want to strike. A low barrier to entry will bring tons of new fraudsters into the fold and the success rate will keep them coming back for more.

Here is some quick advice that will hopefully set you on the right path:

- Card Fraud: Enhanced communication between issuers and merchants upstream in the disputes channel is essential. There are services that can assist with this, but it’s important to implement streamlined, proactive communication channels. Downstream: leverage adaptive behavioral analytics to detect subtle anomalies in genuine customer behavior.

- Payments Fraud: Monitor incoming payments for first party fraud and money mule activity. Outgoing payments are where your liability rests, but it’s important to not stop there. Use adaptive behavioral analytics across incoming and outgoing payments channels to understand money mule networks and implement holistic detection.

- Application Fraud: In addition to robust pre-book detection, leverage post-book events and behavior to understand risk after an application is approved. This includes adaptive modeling across monetary and non-monetary events to detect bust-outs before they occur.

And for all use cases – know your MO’s. First party fraud breeds very different behavior than third party fraud and you need to map these behaviors to your data and modeling.

Stay vigilant!

Share