Ahead of the launch of the FedNow Instant Payments System in 2023, targeted ahead of July, The FedNow Community is running regular sessions to help financial institutions (FIs) prepare for all elements of the transformation. Featurespace founder, Dave Excell took part in their recent Fraud Mitigation Solutions webinar to share best practice alongside other industry experts. The session was hosted by Mike Timoney, Vice President for Secure Payments at Federal Reserve Bank of Boston.

FIs seeking input on faster fraud

Timoney outlined that the topic of fraud mitigation has generated widespread interest across the FedNow Community as well as the payments industry at large. FIs have two fundamental areas of concern:

- Where is the best starting point when it comes to fraud solutions in support of instant payments?

- How can they evaluate existing fraud tools, strategies, and controls to augment them for instant payments?

“I always take a step back and think about the customer and their user experience when they are accessing instant payments,” explained Excell. “How do we want the fraud solution to interact with that experience both in terms of how the customer will explore and discover the instant payment options available to them, and then what are the different scenarios they might encounter.”

In instant payments, as with any payment type, there is the happy flow and the unhappy flow when initiating a transaction. FIs need to accurately calculate fraud risk and make a real-time decision about whether to apply any additional authentication with the customer, to avoid the unhappiest flow which is that the customer be a victim of fraud. To be able to step-up authentication and verify a customer, a fraud prevention must be able to manage the orchestration of those processes into the customer experience.

“Ideally we want to be able to automate as much as possible,” continued Excell. “We need to consume data sources to feed Artificial Intelligence (AI) systems. AI gets smarter by having access to good quality data.”

“When thinking about the user experience holistically and not just the instant payment itself we are tracking those data sources. For example, has a customer come through a mobile banking application and tracking this through in terms how did they authenticate? What actions did they perform? Did they check their balance? Was a new payee added? We capture that sequence of activity to really understand the intent of what the customer was trying to do.”

Protecting new payment types

When new payment types come to market, FIs must think about their customer base and understand their level of education on the benefits, as well as the potential risks. Making customers aware of when it is appropriate to use instant payments in order to protect themselves.

“For example, if you are doing a large value transfer does it really need to be transferred immediately or can an existing payment solution be used?”, asks Excell. “Make sure customer facing teams such as customer support also understand the risks associated with instant payments and can educate customers appropriately.”

“For fraud teams there’s additional data available in instant payments compared to what’s traditionally been available. That often means that existing controls and processes organizations have put into place over years or decades of experience, in terms of fighting fraud up and keeping their customers safe will need to be reconsidered. One of the key changes for instant payments is it requires an immediate decision, so rather than having the time to look at a series of transactions, such as a customer making multiple transactions over a 24-hour period collectively, now we need to make instantaneous decisions on each of those transactions individually.”

“This means adapting and rethinking through those processes; understanding the impact of immediate decision and what other data is needed to support that; deciding what the sequence is when a transaction doesn’t sit comfortably within your risk strategy; and choosing the right technology that can respond in real-time. For instant payments, fraud prevention solutions must integrate all user experiences, including adapting existing ones.”

Rules versus machine learning for faster fraud prevention

“We still see a majority of customers are very comfortable in terms of the rules -based strategies that they have in place,” notes Excell. “We advance those and make them more effective by incorporating elements of machine learning to support the identification of high risk transactions.”

Adaptive machine learning can assist rules-based strategies and improve risk scoring on instant payments transactions, without the need to rip and replace existing fraud systems but augmenting them to create a holistic customer view across all payment types.

“There’s a lot of solutions out there that institutions may already be using that provide that rules capability, and it’s about ensuring that they are able to be upstream and part of the transaction authorization process before the money moves out of the institution.”

Instant payments and mule accounts

Excell outlines one of the challenges of instant payments, “because the money is moving a lot quicker there’s a need to monitor funds out and funds into your institution. If fraud is taking place in the financial system, it is likely that fraud funds will move to another account. It’s crucial to monitor inbound transactions to understand if there’s a change or mule account which will then be further used to move that money around, potentially outside of the financial system.”

Global examples of instant payments fraud prevention

The role of customer education cannot be underestimated. One well-established real-time payments market is the UK, where FIs have invested in consumer awareness campaigns.

“HSBC did a great video series in terms of educating their customers about scams, so I actually encourage people to search for those,” says Excell. “HSBC has some really good short videos in terms of increasing education and awareness about the scams that can take place.”

“At the introduction of Faster Payments in the UK, the initial way in which that system was protected was to almost put a fortress around a lot of the digital real estate that the banks had. The focus was on additional customer authentications (which gave a poor customer experience) so that the FI could then trust all the actions that were taking place subsequently. Which is why now we have seen a rise in scams. Scammers know that you that they needed to pass the authentication control, so they make the customers do this. This gave the banks a false sense of security because the customer had authenticated everything, and the assumption was that from that point on, everything was legitimate. It’s really important to continue to monitor all of the activity post authentication with continuous verification.”

Timoney noted, “From a campaign perspective the UK has a Take Five for Fraud campaign where they’re really trying to educate the consumer about the scam frauds and authorised push payment fraud…I think education is very important but there are some of those tools out there as well.”

Measuring instant payments fraud

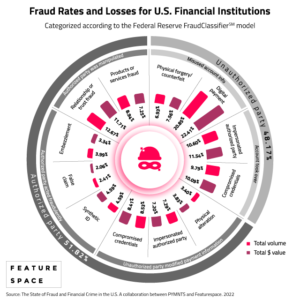

“In 2020 The Fed worked with the industry to come up with The FraudClassifier model and that tool allows people to really try and look at fraud from a consistent view,” explained Timoney. “We’ve laid it out from different ways to categorise fraud but also provided consistent definitions for fraud, because what we found is people were talking about fraud differently. They were classifying it differently and we are trying to get how big is the problem. We couldn’t always get apples to apples, so we’ve seen quite a bit of movement in this now are those people adopting the model.”

Featurespace recently published its report, The State of Fraud and Financial Crime in the U.S. which includes average fraud rates and losses for FIs, categorized against the FraudClassifier model. For the first time, U.S. FIs have access to industry benchmarks which help them understand how their own organization and the industry is performing in the fight against fraud.

“As with other payment types out there, the financial institutions are really the primary line of defence when it comes to these fraudulent transactions,” noted Timoney. “The FedNow Service will also act as a resource centre to both the senders and receivers on the transactions to help mitigate fraud.”

How Featurespace prevents instant payments fraud

“One of the things that we focus on is that a majority of customers are good genuine customers, they are the ones that we want to do business with,” said Excell. “When we’re thinking about our approach for fraud and risk mitigation, we learn what are the behaviours of those good customers, and make sure that we can continue to enable those customers to transact and have equitable access to all of the different financial services and products that they want to be able to access. By focusing on what looks good, we’re able to identify things that change, things that potentially don’t feel right, so we can respond to new types of fraud attacks based on those anomalies.”

Open platform

A platform for instant payments fraud prevention needs to be fast. But speed covers multiple vectors. For faster deployment and integration, to enable institutions and customers to be ready for the launch of FedNow and ahead of the fraud trends that will target a new rail and customer experiences.

“The way to achieved time to value is to make the solution very simple. We support the majority of our customers using our solution in the cloud, so it minimises the technology onus on organisations to be able to install and maintain the platform. Utilizing the ISO20022 standard to be able to quickly integrate, and taking that data and being able to orchestrate into different data providers and different systems that you already have.”

Dave Excell, Founder of Featurespace

Real-time decisions

To make decisions in milliseconds and request additional authentication, when required, from customers to stop fraud and facilitate genuine transactions. And to update strategies in real-time with new learnings.

Maximum explainability

To give fraud operations teams clarity on analytic performance, model decisions, and why transactions are flagged as fraud. Create confidence for analysts in the investigations process and make those investigations intuitive.

Accurate & adaptive AI

To ensure strategies remain accurate in the face of changing fraud patterns, for both rules and models, through adaptive machine learning that protects customers and reduces false positives.

“One of the things that I’m really proud of from our examples of deploying our platform with TSYS, ones of the largest card issuers during the pandemic is that at our models remained extremely stable. So when the US went into lockdown our models recalibrated within three days and we were back to the same performance, after we saw the huge shifting consumer and business activity: from shifting from a lot of that card present transactions to card not present transactions, and also the shift in terms of different fraud typologies.”

Dave Excell, Founder of Featurespace

“When I think about instant payments, it is not necessarily as a payment channel in its own right,” continues Excell. “For me it is around understanding holistically what that customer is doing and all of the other ways in which they are transacting, from their data. We really work with our subject matter expert teams to provide that insight and value back, and we’ve packaged a lot of things around these use cases to enable customers to go live really quickly.”

Discover Featurespace and ARIC Risk Hub can help your organization to be ready for the launch of the FedNow Instant Payments service.

Read the paper: Instant Payments – Preventing Fraud and Financial Crime in Real Time

Share

by

by