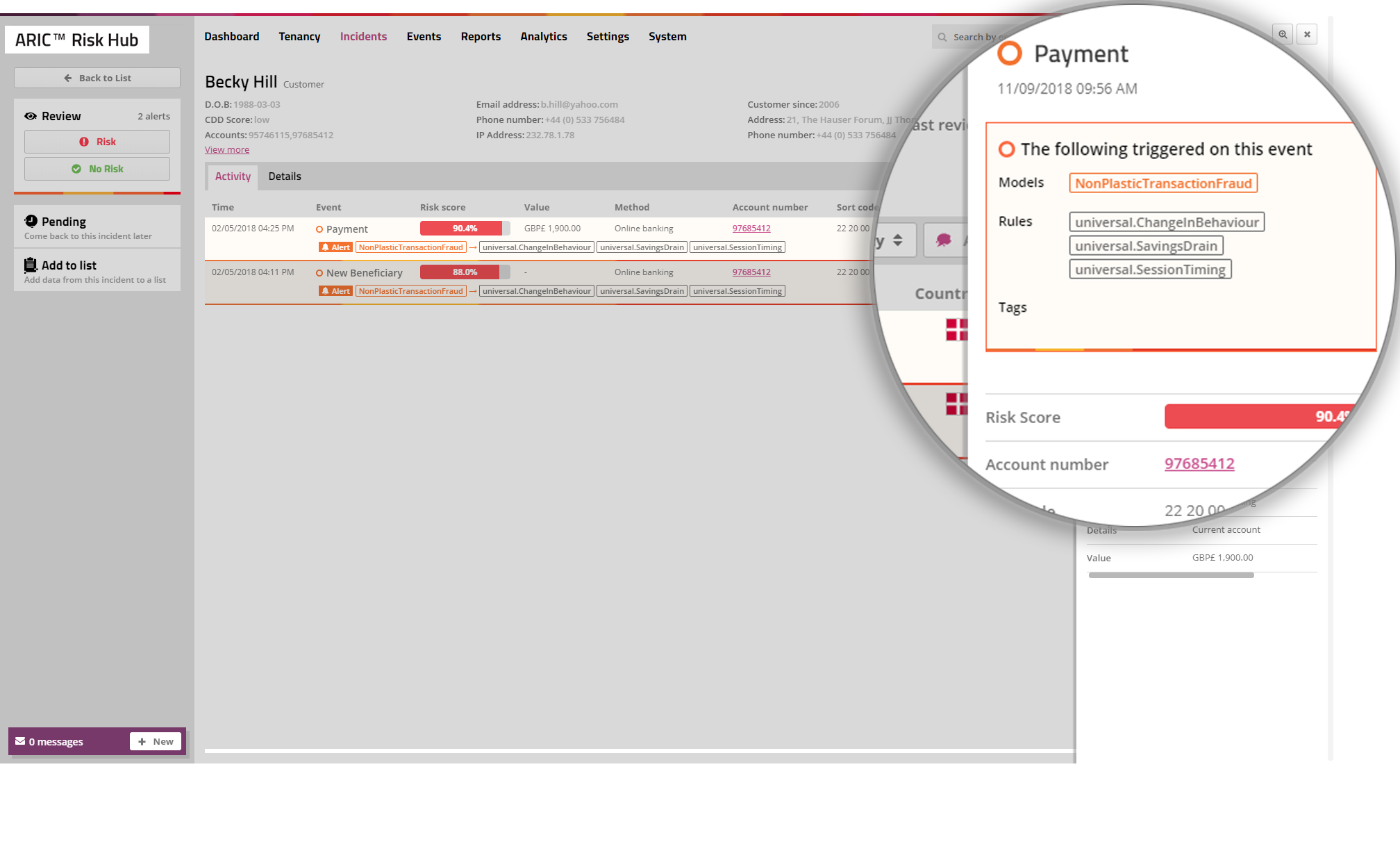

White Label ARIC™ Risk Hub

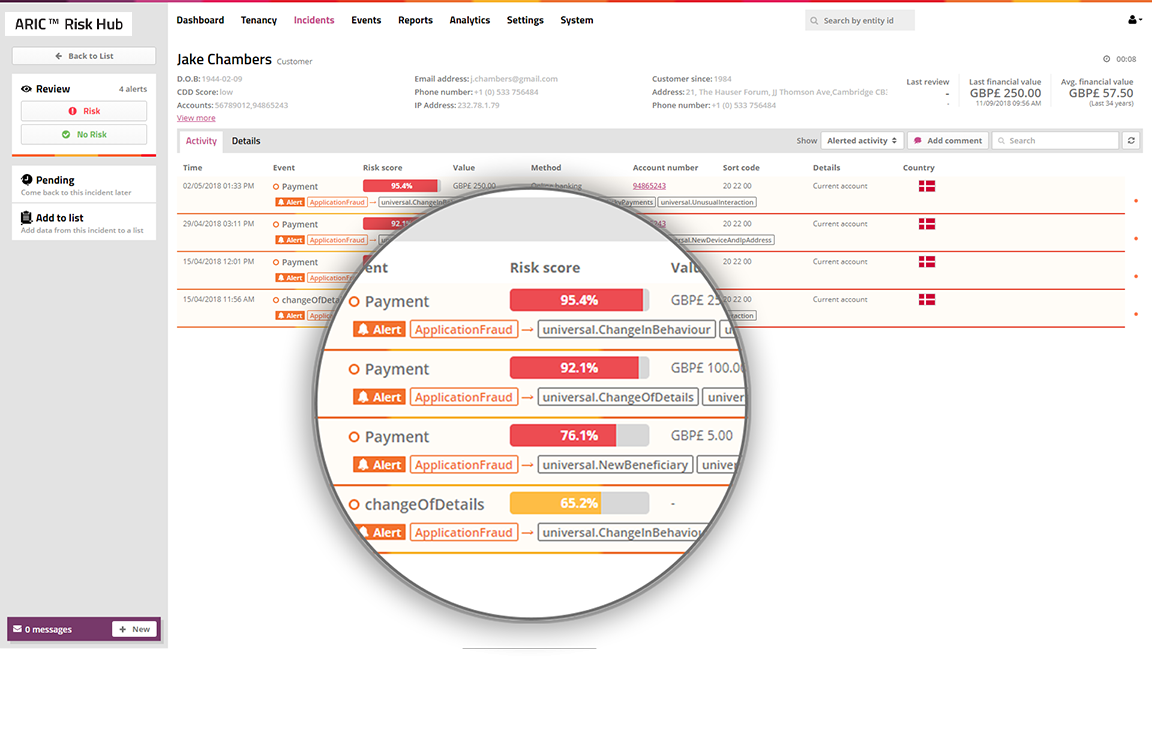

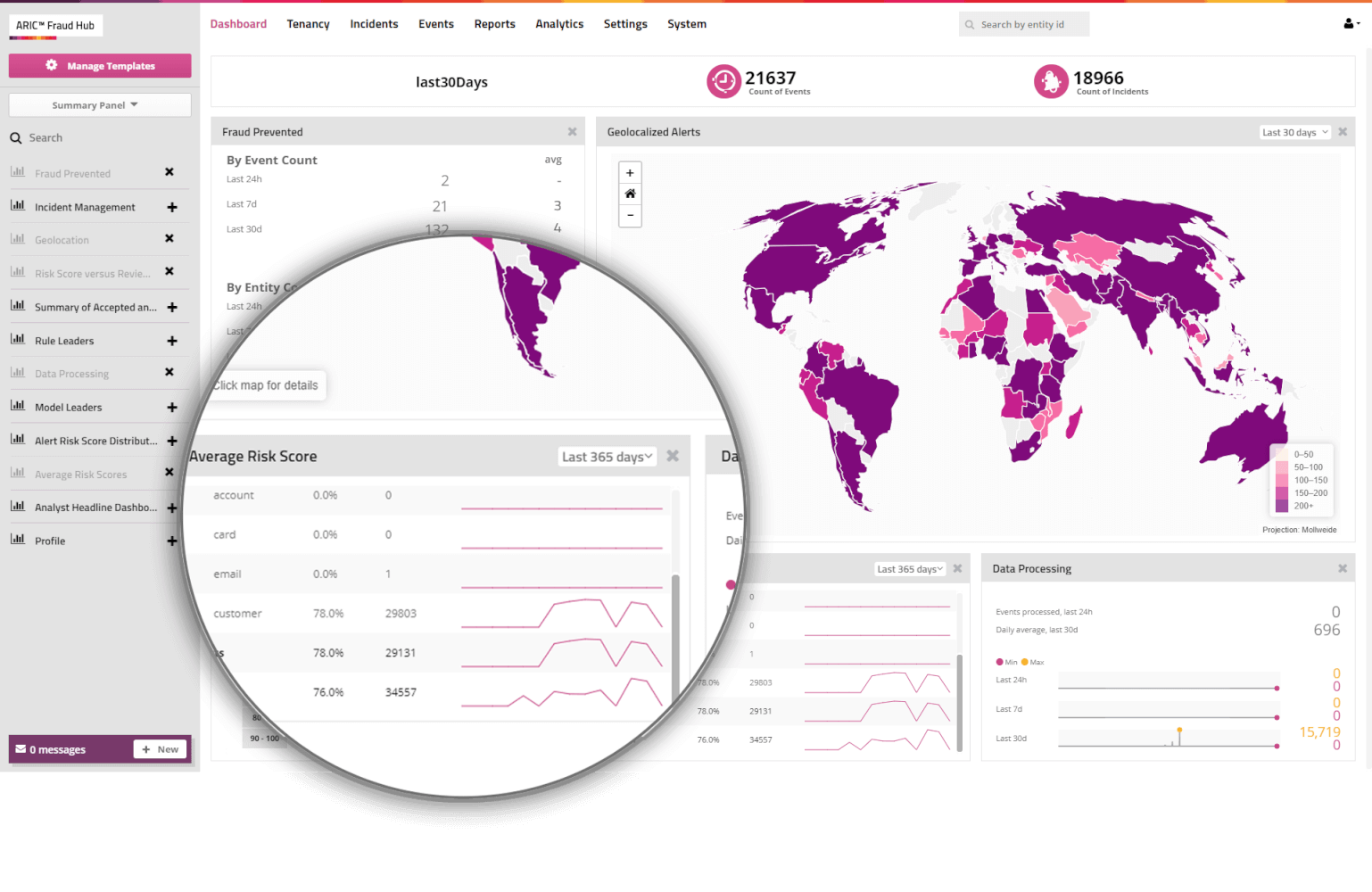

Provide real-time fraud protection and AML transaction monitoring with machine learning to your clients, while opening new revenue streams for your business.

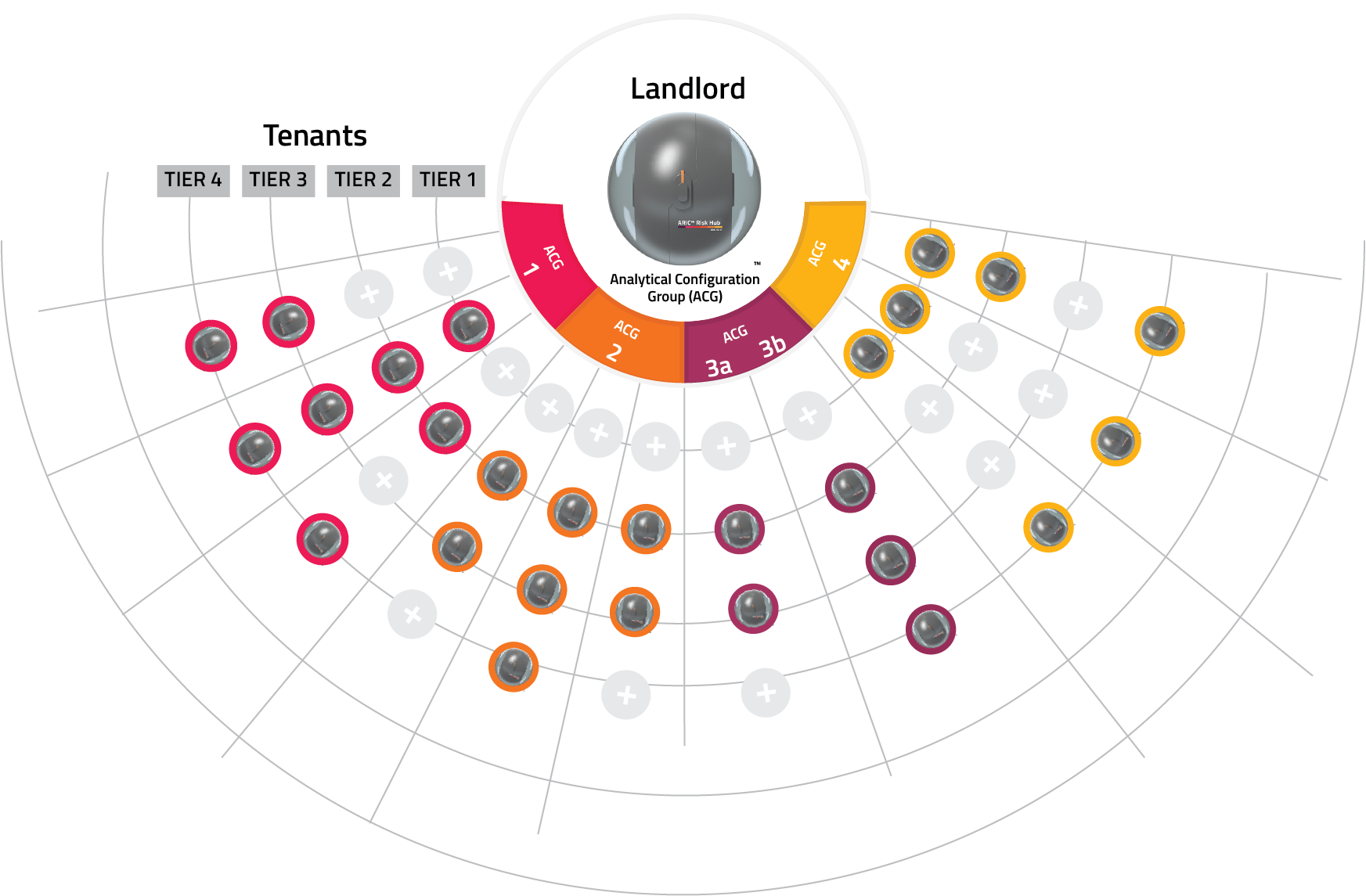

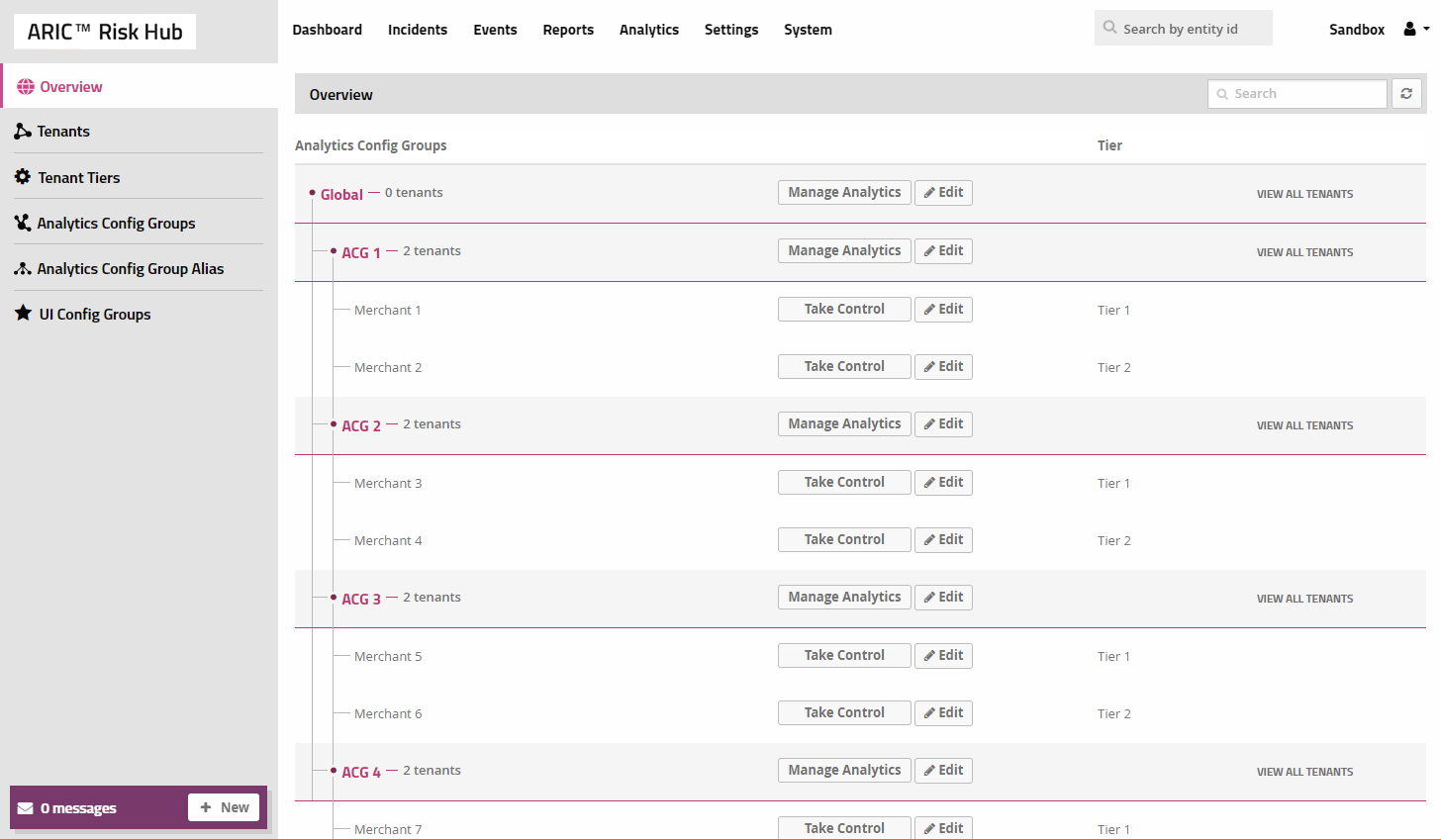

Powered by the multi-award winning ARIC Risk Hub, with mega multi-tenancy, White Label ARIC Risk Hub uses Adaptive Behavioral Analytics to protect your clients from suspicious transactions across all payment types and channels.

White Label ARIC Risk Hub gives Issuers and Acquirers full control of the experience available to your customers.